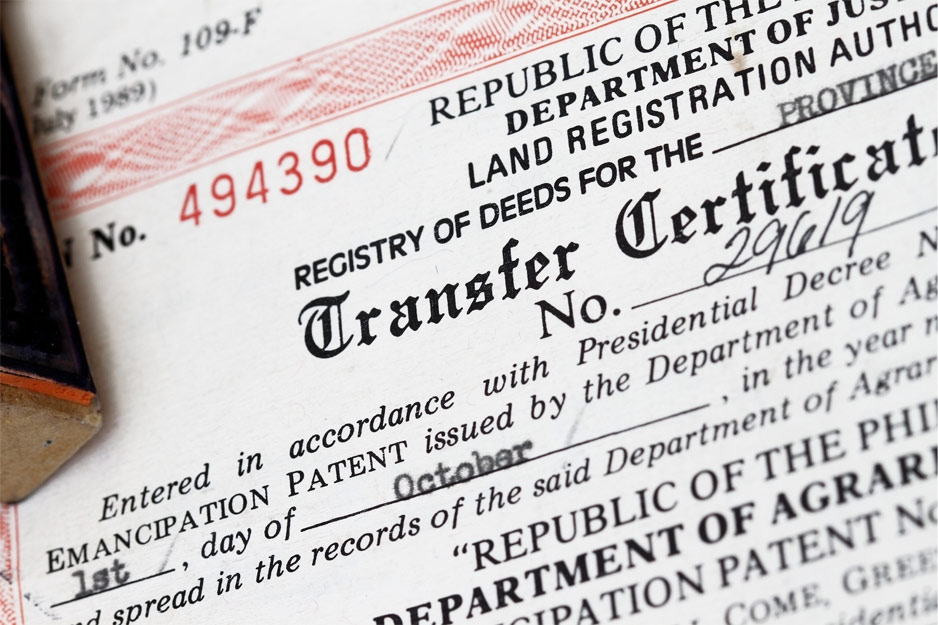

If your parent has died and you are entitled to their house, how do you get the deed? Property is normally transferred by instruments called deeds from one person to the next. The deeds are all recorded in the County Clerk’s office so that a title examiner can research and find the history of a property as it is deeded from one person to another. But what happens when the person owning the property dies? They can’t deed the property to their heirs, but the legal process to transfer that property is part of probate.

Despite what you may have heard, “probate” is not a nasty word, at least in Texas. Probate is the process of orderly transitioning the assets from the deceased person to the proper heirs or beneficiaries. If there is a Will, we probate the Will and the terms of the Will control who becomes the owner of the property. If there is no Will, the property passes by the laws of descent and distribution pursuant to the Texas Estate Code.

In either case, with or without a Will, the court must enter an order to determine who is the executor of the estate or who is the owner of the property. Therefore, you can’t get “the deed” to a property by any of the following:

- Physically possessing the deed granting the property to your parent

- Changing the address for tax bills with the appraisal district

- Recording an affidavit in the real property records saying you are the owner of the property.

None of the above is effective because they aren’t a substitute for real probate. So, if you need to transfer the title of your loved one’s property to you or others, consult with Pyke & Associates and we will always diagnose your problem, and quote a fixed fee where possible, before we ever charge you a dime. That is part of our commitment to take the fear and unpredictability out of the probate process.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, specific tax, legal or accounting advice. We can only give specific advice upon consulting directly with you and reviewing your exact situation.