What’s the difference between doing planning with a will versus a revocable trust? Most people understand the concept of a will. It is someone’s written legal instructions as to how their assets are being divided and who is going to be in charge – their executor. A revocable living trust is something that many have heard about, but few fully understand.

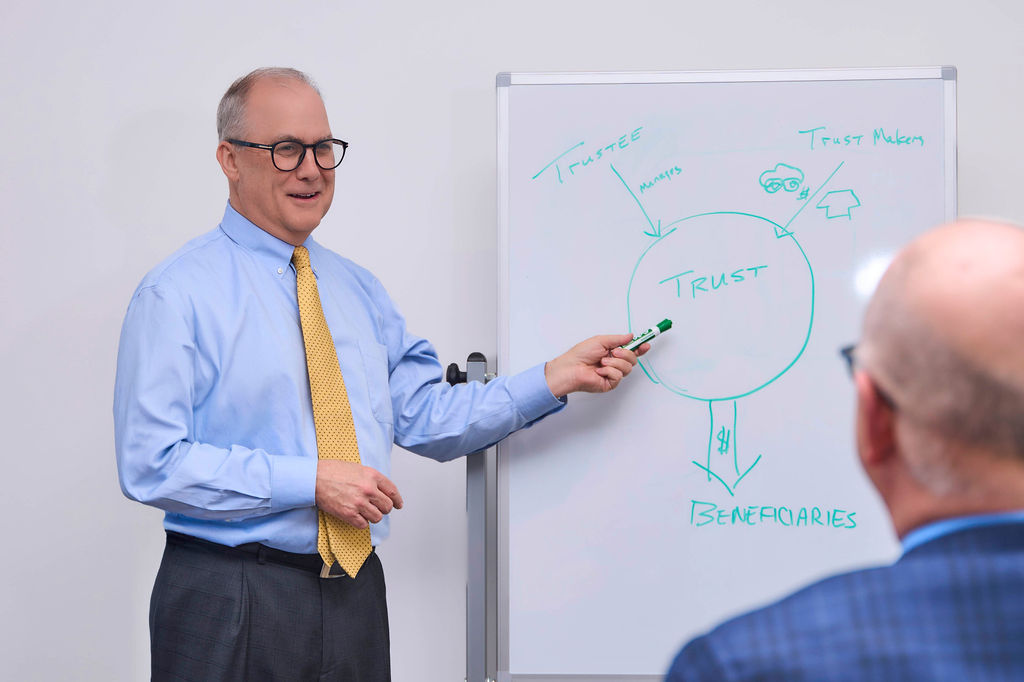

To begin, what is a trust? A trust is a 3-party agreement where someone creates a trust called the settlor, grantor, the trust maker, all meaning the same thing. I prefer to use the term trust maker. The second party who is a trustee, is the person appointed to run the trust, and the third party, that’s the beneficiary, is the person who gets to use the trust. All trusts have those three positions and from there the variations are manifold. So what is a revocable living trust?

First, it’s revocable meaning that it can be changed or totally deleted at any time in the future. The person who’s created the trust, the trust maker, has not given up control of their assets in any way. So if someone decides to create a revocable living trust, they are the trust maker, and who do they want to manage their assets when they have full mental capacity? Themselves, of course. And who do they want to benefit from their own assets that they’re managing? Again, themselves.

So a revocable living trust is simply a 3-party agreement where you, the trust maker, are all of the parties. It sounds like a legal fiction, and in some ways, it is. For income tax purposes, a revocable living trust is disregarded. It has neither a positive or a negative impact on your estate taxes. It is also disregarded by creditors, so those who attempt to tell you that a revocable living trust will protect your assets are not being honest with you. But in some regards, the trust makes a real difference.

If you transfer your assets during your life to the revocable living trust, then the trust sets forth the rules on who’s going to manage your assets in case of your incapacity or disability, and what happens to your assets when you die, which can include that the trust continues on for your beneficiaries and those trusts will not be revocable, can have tax advantages, and definitely have advantages on protecting assets from your beneficiaries’ creditors. Now, we can build those protections into a will as well, so why would you choose a trust over a will as a fundamental part of your estate planning?

In the next post, we’re going to look at the advantages of a will and a trust and their subsequent disadvantages.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, specific tax, legal or accounting advice. We can only give specific advice upon consulting directly with you and reviewing your exact situation.